Understanding Lifetime Table Instructions: A Comprehensive Guide

Lifetime tables, also known as mortality tables or actuarial tables, are fundamental tools used in actuarial science, demography, and various financial planning applications. These tables provide a statistical representation of the probability of death at different ages within a specified population. Understanding how to read, interpret, and utilize lifetime table instructions is crucial for anyone working with life insurance, annuities, pension plans, or population projections.

The construction of a lifetime table relies on historical data concerning mortality rates. Demographers and actuaries collect and analyze large datasets to determine the proportion of individuals who die at each age. This data is then used to estimate the probability of survival and death for a hypothetical cohort of individuals born at the same time. The table essentially follows this cohort throughout their lives, tracking the number of survivors at each age until no one remains.

The information contained within a lifetime table is presented in a structured format, with each row representing a specific age. The columns provide various statistics related to mortality and survival probabilities. The exact columns included can vary depending on the specific purpose of the table, but several key columns are commonly found in most lifetime tables.

Key Components of a Lifetime Table

Understanding the key components of a lifetime table is paramount to its effective use. These components, represented as columns within the table, provide the essential data points needed for actuarial calculations and demographic analysis. Some of the most crucial components are detailed below.

Age (x): This column indicates the exact age, usually in years, for which the statistics in that row are applicable. It typically starts at age 0 (birth) and extends to the maximum age any member of the population is likely to reach. Each subsequent row represents the next consecutive age.

Number Living at Age x (lx): This column, often denoted as lx, represents the number of individuals surviving to the beginning of age x out of an initial cohort, often denoted as l0. This starting cohort is an arbitrary number, usually a round number like 100,000, and serves as the baseline for the table. The lx value decreases with increasing age, reflecting the mortality within the cohort.

Number Dying between Age x and x+1 (dx): This column, often denoted as dx, indicates the number of individuals from the cohort who die between age x and age x+1. This value is calculated as the difference between the number living at age x (lx) and the number living at age x+1 (lx+1). In other words, dx = lx - lx+1.

Probability of Dying between Age x and x+1 (qx): This column, often denoted as qx, represents the probability that a person alive at age x will die before reaching age x+1. It is calculated by dividing the number dying between age x and x+1 (dx) by the number living at age x (lx). Therefore, qx = dx / lx. This is a critical value for calculating life insurance premiums and annuity payments.

Probability of Surviving from Age x to x+1 (px): This column, often denoted as px, represents the probability that a person alive at age x will survive to age x+1. It is the complement of the probability of dying, meaning px = 1 - qx. This value is essential for projecting population growth and estimating the likelihood of individuals reaching certain milestones.

Expectation of Life at Age x (ex): This column, often denoted as ex, represents the average number of years of life remaining for an individual who has reached age x. It is a crucial statistic for assessing the overall health and longevity of a population. Calculating ex is a more complex process, involving the summation of future survival probabilities. A simplified explanation treats it as a weighted average of the remaining years of life, weighted by the probability of surviving each year. More precisely, it is the sum of future conditional survival probabilities.

Beyond these core components, some lifetime tables may include additional columns such as the force of mortality (µx), which represents the instantaneous rate of mortality at age x, or various commutation functions, which are used to simplify actuarial calculations. The specific columns included will depend on the intended use of the table and the level of detail required.

Interpreting Lifetime Table Data

Once the key components of a lifetime table are understood, the next step is to interpret the data and extract meaningful insights. This involves analyzing the trends and patterns revealed by the table and applying them to specific situations. It is important to remember that lifetime tables are based on statistical averages and do not predict the lifespan of any individual person. Instead, they provide a probabilistic framework for assessing mortality risks across a population.

For example, consider a hypothetical lifetime table with an initial cohort of 100,000 individuals at age 0 (l0 = 100,000). If the table shows that l50 = 80,000, it means that 80,000 individuals from the original cohort are expected to survive to age 50. Furthermore, if the table shows that q50 = 0.005, it means that there is a 0.5% chance that a person who is currently age 50 will die before reaching age 51.

The expectation of life at a given age (ex) can also be interpreted in a meaningful way. If e65 = 20, it means that a person who has reached age 65 is expected to live, on average, for another 20 years. It's crucial to understand that this is an average. Some individuals will die sooner, and others will live longer. The expectation of life does not provide any guarantees about individual longevity.

Trends within the lifetime table can also reveal important information about mortality patterns. For instance, a table might show a decline in the probability of death (qx) at younger ages compared to older tables, reflecting improvements in healthcare and overall living standards. Similarly, an increase in the expectation of life (ex) over time would indicate that people are living longer on average.

When interpreting lifetime table data, it's essential to consider the specific population to which the table applies. Mortality patterns can vary significantly based on factors such as gender, race, socioeconomic status, and geographic location. A lifetime table based on the general population may not be appropriate for assessing the mortality risks of a specific subgroup with different demographic characteristics. Using the correct table is crucial for accurate calculations and reliable predictions.

Applying Lifetime Tables in Practical Scenarios

Lifetime tables are not merely theoretical constructs. They have numerous practical applications in various fields, including insurance, finance, and demography. Their ability to provide a statistical framework for assessing mortality risks makes them indispensable tools for planning and decision-making.

Life Insurance: Life insurance companies rely heavily on lifetime tables to calculate premiums. The probability of death (qx) at different ages is a primary factor in determining the cost of insurance. Policies targeted to older individuals commands higher premiums due to the elevated risk of death. The tables enable life insurance companies to balance the premiums collected with the benefits paid out, ensuring the financial sustainability of their business operations. Different tables might be used for males and females and smokers vs. non-smokers.

Annuities: Annuities are financial products that provide a stream of income over a specified period, often for the remainder of the annuitant's life. Lifetime tables are essential for calculating annuity payments. The number of years a person is expected to live, as indicated by the expectation of life (ex), influences the amount of each payment. They help annuity providers determine the appropriate payment amounts to ensure they can meet their obligations while also generating a profit.

Pension Plans: Pension plans provide retirement income to employees. These plans use lifetime tables to project the number of retirees who will be receiving benefits in the future, as well as how long they will receive those benefits. This information is essential for funding the plan adequately and ensuring that sufficient assets are available to meet future obligations. Underestimating longevity could lead to underfunded liabilities in the pension plan.

Population Projections: Demographers use lifetime tables to project future population sizes and age distributions. By combining mortality data from the table with birth rate data, they can estimate how a population will change over time. These projections are critical for government planning, resource allocation, and social policy development. They help governments anticipate future needs in areas such as healthcare, education, and social security.

Healthcare Planning: Healthcare providers use lifetime tables to plan for the future healthcare needs of a population. By understanding the age distribution of the population and the associated mortality patterns, they can anticipate the demand for various healthcare services and allocate resources accordingly. This helps ensure that healthcare systems are prepared to meet the needs of an aging population.

In conclusion, lifetime tables are indispensable tools for understanding mortality patterns and assessing risks across a population. Their application across various fields highlights their practical importance in finance, insurance, demography, and healthcare. A thorough understanding of their key components and their interpretation unlocks their potential for informed decision-making and strategic planning.

Lifetime 6 Foot Folding Picnic Table

Lifetime 60346 Assembly Instructions Manual Manualslib

Lifetime 80421 Assembly Instructions Manual Manualslib

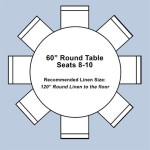

Lifetime 60 Inch Round Nesting Table Commercial

Lifetime 6 Picnic Table Assembly Instructions Manual Manualslib

How To Fold Up A Folding Table Tutorial With Easy Instructions

Lifetime 6 Foot Fold In Half Table Commercial

Lifetime 6 Foot Seminar Table Commercial

Lifetime 60208 Assembly Instructions Manual Manualslib

Review Ysis Of S Hottest Ing Commercial Tables In The Us

Related Posts